Solyndra was a manufacturer of cylindrical panels of copper indium gallium selenide (CIGS) thin film solar cells based in Fremont, California. Although the company was once touted for its unusual technology, plummeting silicon prices led to the company’s being unable to compete with conventional solar panels made of crystalline silicon. On August 31, 2011, Solyndra announced it was filing for Chapter 11 bankruptcy protection, laying off 1,100 employees, and shutting down all operations and manufacturing. The company filed for bankruptcy on September 1, 2011.

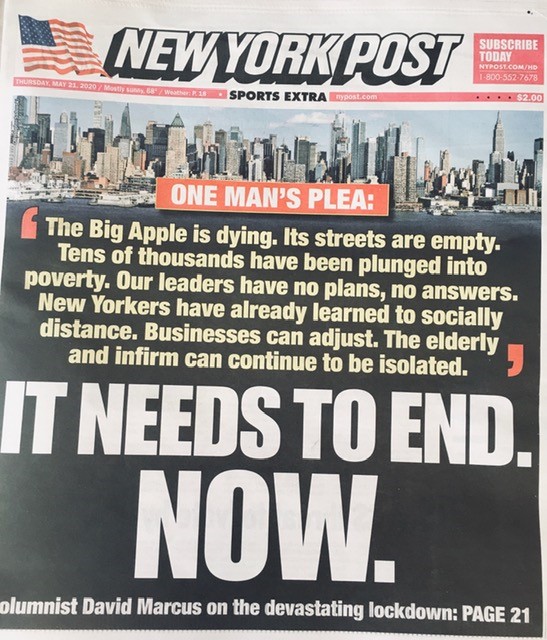

THIS IS THE GREEN NEW DEAL – A COMPLETE FAILURE COSTING TAXPAYERS ALMOST $1 BILLION LARGE

In September 2011 the company ceased all business activity, filed for bankruptcy under Chapter 11, Title 11 of the United States Bankruptcy Code, and laid off all employees. The company was also sued by employees who were abruptly laid off. Solyndra was raided by the FBI investigating the company. Federal agents visited the homes of Brian Harrison, the company’s CEO, and Chris Gronet, the company’s founder, to examine computer files and documents. Also, in September 2011, the US Department of the Treasury launched an investigation. Bloomberg reported in 2011 that Solyndra’s $733 million plant had whistling robots and spa showers, along with many other signs of extravagant spending,

Solyndra received a $535 million U.S. Department of Energy loan guarantee, the first recipient of a loan guarantee under President Barack Obama’s economic stimulus program, the American Recovery and Reinvestment Act of 2009.

However, Solyndra officials used inaccurate information to mislead the Department of Energy in its application. The loan program took a $528 million loss from Solyndra. Additionally, Solyndra received a $25.1 million tax break from California’s Alternative Energy and Advanced Transportation Financing Authority. SoloPower also received similar funding from the U.S. Department of Energy.

Solyndra’s owners, Argonaut Ventures I LLC and Madrone Partners LP” will “realize the tax benefits of between $875 million and $975 million of net operating losses, while more senior creditors, including the Department of Energy, which provided a $535 million loan guarantee to Solyndra, will receive nearly nothing.”