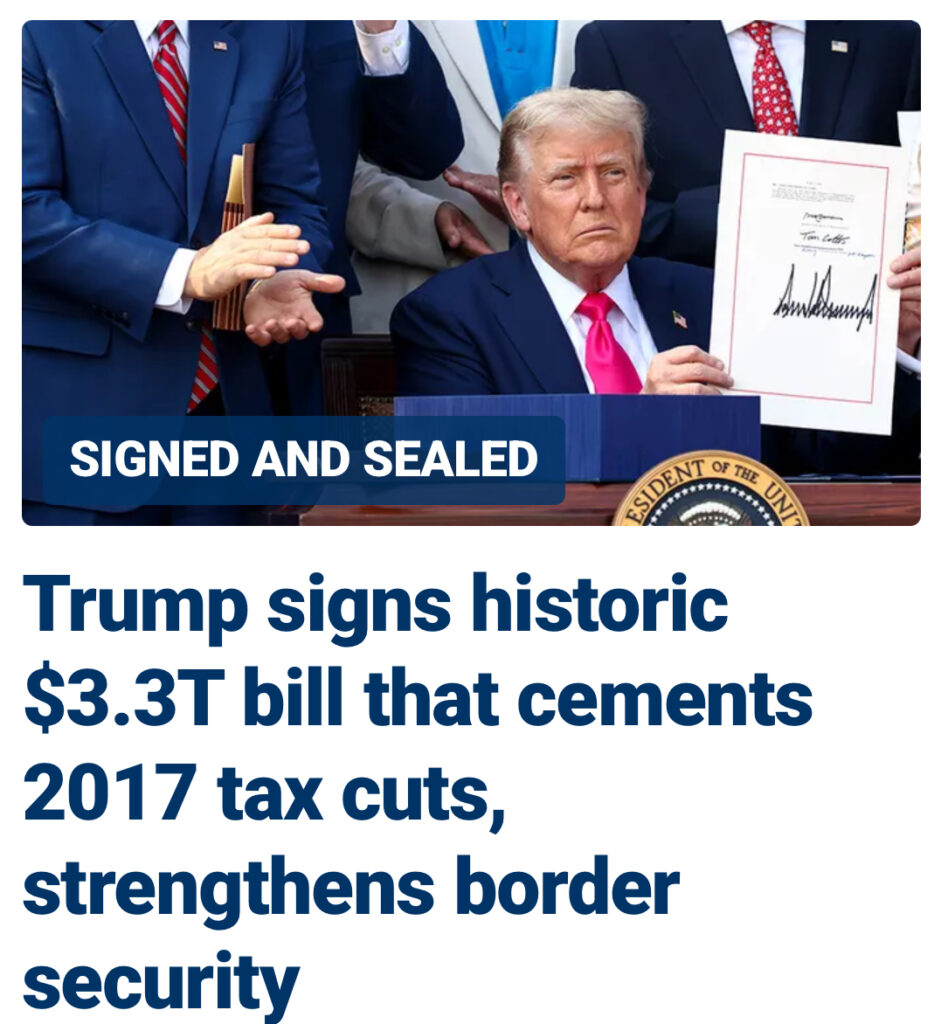

The Demonic Pervs continue to sell lies on social media, calling the “One Big Beautiful Bill” (OBBB)as a give away to the rich. Nothing can be further from the truth.

Number 1: the bill extends the Trump #45 tax cuts of 2017 (Democrats want the little guy to pay more)

Number 2: no tax on tips up to $25,000 starting in 2025-2028

Number 3: no tax on overtime pay up to $12,500 starting in 2025-2028

Number 4: The standard deduction was increased to $6,000 for those over 65 years old (phasing out for individuals with incomes over $75,000, couples over $150,000)

Number 6: Requires able bodied individuals on Medicaid to work 80 hours per week with more frequent eligibility checks. (please don’t shed any tears for your neighbor)

Number 7: The Federal Government will no longer allow States to provide Medicaid to Illegal Aliens, this penalizes the Blue States

Number 8: The Federal Government will reduce the state subsidies to SNAP recipients and those with temporary status.

The bottom line here is two fold, hard working men and women who are the backbone of society will see less taxes on tips and overtime (only a three year duration). Those over 65 will benefit by the increase in the standard deduction of $6000. And the tax cuts from Trump 45 have been permanently etched in law.

Payments to illegal aliens collecting Medicaid and SNAP benefits will take it on the chin. Many of these are couch potatoes playing video games or watching TV, but can do able body work. The SNAP program is a free giveaway to the leach who continues to buy soda, chips, candy and garbage food. Now they will have to do with less. It is time they ate healthy by budgeting their SNAP payments. Believe us, no one will starve. According to the Pervs, many chidren will die from starvation.

One thing we didn’t mention was that the “OBBB” put a wrench in the GREEN MACHINE.

The “One Big Beautiful Bill,” as passed by the Senate, includes significant changes to tax credits, with some being eliminated or modified. Specifically, the bill eliminates the clean electricity production and investment credits for projects placed in service after 2027, with some exceptions for certain baseload power sources. Additionally, the bill terminates the energy-efficient commercial buildings deduction for new construction after June 30, 2026, and the new energy efficient home credit after the same date.

Federal EV tax credits will disappear Sept. 30, instead of in 2032 as originally planned under President Joe Biden. Other home improvement credits go away at the end of the calendar year. The sudden deadlines could set off a scramble to buy cars and start home projects before the credits expire.