SHOCKING! Inflation is running full steam ahead.

2022 Social Security Changes – COLA Fact Sheet

https://twitter.com/search?q=social+security+increase+2022&ref_src=twsrc%5Egoogle%7Ctwcamp%5Eserp%7Ctwgr%5Esearch

Inflationary data suggests the Fed is now stuck between a rock and a hard place

Hawaii Six O – Gary Wagner

Kitco Commentaries | Opinions, Ideas and Markets Talk

Featuring views and opinions written by market professionals, not staff journalists.

The government released the inflationary report for September today vis-à-vis the CPI (Consumer Price Index), which showed that inflation continues to increase. In July of this year, the consumer price index reached an apex of 5.4% and then decreased to 5.3% in August. Today’s report shows that inflationary pressure is now back to 5.4% year over year. Estimates by economists polled by Dow Jones were forecasting that this rate would increase only by 0.3% keeping the year-over-year rate at 5.3%.

The current inflationary pressures are once again at a 30-year high. More importantly it is well above the target of the Federal Reserve. The dual mandate of the Federal Reserve is to maintain maximum employment and a 2% inflationary target rate. Recent rates have been more than double of the Fed mandate. The U.S. Bureau of Labor Statistics report revealed that consumer prices rose 0.4% in September which took the year-over-year gain back to 5.4%.

However, the Federal Reserve adjusted its dual mandate to focus upon maximum employment and let inflation run hotter than their 2% target. The thought process by the Federal Reserve was that much of the current inflationary pressures are transitory in nature and will subside in a relatively short time.

According to MarketWatch, “Stronger-than-expected U.S. inflation data for September has the bond market now considering the risk that the Federal Reserve may end up being forced to tighten interest rates into a stagnating economy with persistently higher price rises.”

The Federal Reserve is most likely correct in predicting that certain components of our goods and services have seen inflationary pressures that are transitory due to supply and labor shortages. But the real issue is the rising costs of food and energy. Many analysts, including myself believe that the cost of energy and food could continue to rise and create inflation that is systemic and prolonged. Gasoline prices rose 1.2% for the month which resulted in an annual increase of 42.1%. In September, food prices also had a dramatic gain increasing by 1.2% and increased 12.6% year-over-year.

Previous post below from July

Is this music to your ears? Prices rising, tempers flaring, money burning making your day? At last count, by the government front men who quietly burped out ( and you know they are lying) that inflation catapulted over 5%; the highest in a dozen years. But the cognoscenti economists believe inflation has raised its ugly head above the 10% level. Powell says this is transitory, just a tempest in a teapot.

Many of those who suffer from the political amalgam that saturates their brain with cool aide could not recognize their own suicide even if they were soaked in a bloody suit. Shortages of chips have delayed automobile production, copper prices through the roof along with housing prices, gold, yeah gold is spiraling upward toward new highs. But TRANSITORY IS THE WORD as the FED floods the land with trillions upon trillions of fiat currency. Is it time to bring out the fire hoses? Stop the Deal before it is too late. At last count the U.S. is on the hook for $25 trillion, but counting all obligations, like Social Security, Medicare etcetera, the numbers balloon to $125 trillion. Please, please, don’t burst a blood vessel over this minor detail. See previous posts below.

THE MAN WITH THE GOLDEN FLEECE

First it was salt, then spice, then paper, but in the end it was gold. They tried them all, as they say, “you can fool some of the people, some of the time, but not all of the people all of the time.” And it has come to pass, the “ALMIGHTY DOLLAR” is slowly dissolving like the piece of paper it is printed on. Don’t take our word for it though, check the status of soon to be reserve currencies, like the Chinese renminbi (aka yuan) or perhaps the Russian ruble. Don’t despair, the cryptocurrency world is at your fingertips. If that doesn’t suit you, GO FOR THE GOLD, but SILVER will do just fine. To those of the initiated, they know where the price is headed, and that is north. The everlasting obituary is premature, the body has not been declared mortal. And as the eternal rays provide life to all, the man who has gold in his hand will endure for a lifetime.

Gold has been on a tear of late, rising from the mid 1700’s to the 1840 level. The sign of inflation is in the air. A whiff of the third quarter numbers will reveal what is in the black box. Our guess, and it is only a guess, we are not economists, places the number at 3.5%. You can’t keep a good man down, can you. The second quarter won’t be that horrible though, somewhere in the 2.5% range. Don’t forget that the Biden team has their thumb on the scale. And to make a salient point, economists are always right, it is the timing that is wrong. BTW, they have predicted 8 of the last 4 recessions. Batting 50% is a admirable achievement in most sports.

Billionaire investor Sam Zell is also now buying gold, despite decades of criticizing those who purchase it, reports ETF Trends. Zell says it is because these monetary policies may create inflation like the 1970s and gold could be a hedge.

The latest on inflation, annual inflation rose 4.2% last month, core inflation for the year to date is at 3%. LOOK OUT BELOW!

CLICK HERE FOR A TAKE ON THE HYPERINFLATION BUBBLE – STOCK MARKET SEES THE CALAMITY AHEAD

THE FED JOINS THE CROWD WITH “FEDCOIN” IT TRULY IS WORTH MORE THAN GOLD

How do you pay off your creditors? With MONEY! But if you have none, TEN possibilities exist to neutralized the threat of “PAY UP”: 1. you go bankrupt, 2. get an extension – a longer time to cough up the dough, 3. creditors hire a hitman or sport’s mechanic to do you physical harm, 4. disappear, 5. tell them that you are two big to jail. 6. hire a team of software engineers, 7. hire your own defense team, 8. make a deal, ala Argentina, 9. issue new fiat to payoff the old, and 10. OR YOU CAN JOIN THE CROWD. All not necessarily in the preceding order.

A look into the crystal ball, confirmed by the Ouija tells us that the FED is soon to rollout with great fanfare their own BITCOIN to be called FEDCOIN. Finally, they have got the hint that invisible values have more value than tangible ones. Who would’ve thought of this 245 years ago. Incentivize individuals to work for invisible pay. What a revelation. Now that is what we call the NEW GREEN DEAL. TAKE THAT AOC.

George Washington didn’t have to skip a Silver Dollar over the Delaware. This is space science at its best. The speed of light no faster than a speeding bullet. No treasury printing, no counting of dirty money, no banks anymore, only your own personnel wallet.

But BACK TO THE FUTURE we have seen this play before, the FED and TREASURY cabal are never ahead of the curve.

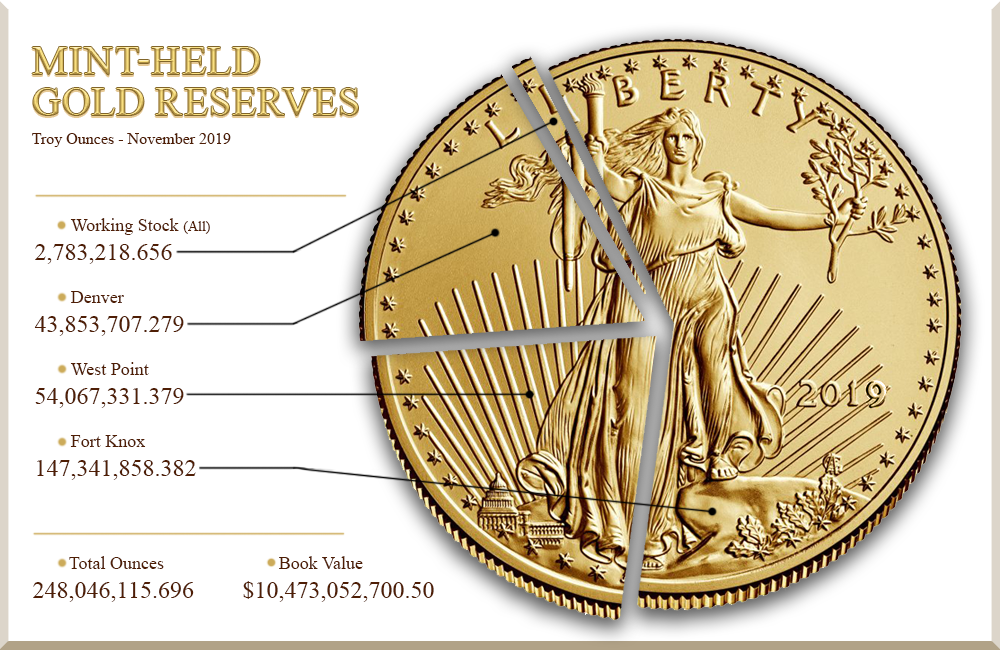

Imagine if they turned their gold haul at FORT KNOX and local mints into Bitcoins early on? The 248,000,000 ounces in storage are now worth a mind boggling 12,400,000,000,000, that is trillion dollars. That is what you call GREEN CACHE.