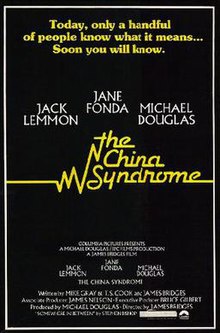

The China Syndrome, the worry that an American nuclear plant meltdown could penetrate the earth’s crust finally ending up in China. A worry to this day. Economically we have seen the reverse, a China economic meltdown, now winding its way through oceans leaving economic woe and devastation in its path. The financial markets have confirmed the economic twister’s wake since China’s stock market swooned 30%. Now it is leaving a financial trail of devastation in our financial markets. The bottom line here is simple. Over the past twenty years China has accumulated a couple of trillion dollars of our money; shipping slave produced goods to the United States in return they purchased foreign companies worldwide.

The bottom line here is simple. Over the past twenty years China has accumulated a couple of trillion dollars of our money; shipping slave produced goods to the United States in return they purchased foreign companies worldwide.

Their bounty was spent gobbling up companies across the global board. These included natural resources, manufacturing, biotech, electronic and software. They are today’s elephant in the economic room. China catches a cold, the world catches the flu.

While other countries economic woes are common place, the United States economy is humming along. This is an anomaly. Questions arise on how our economy has shielded the blow of economic stagnation. It does not seem possible. True that interest rates are at all time lows, oil has imploded, but these circumstances exist in Europe too and their economy is in the tank. Something does not jive hear. Is our government covering something up? That is the question.